Securing Travel Insurance for a Loved One: A Comprehensive Guide

We are starting the discussion of how to arrange travel protection for family members or friends, even when you're not traveling with them.

I would like to start with the basics of travel insurance eligibility and coverage while abroad.

- Gather Essential Information: Before you start, collect the traveler's full name, date of birth, travel dates, destination(s), and any pre-existing medical conditions.

This is crucial for accurate policy quotes. He talks about the fact that inaccurate information can lead to claim denials.

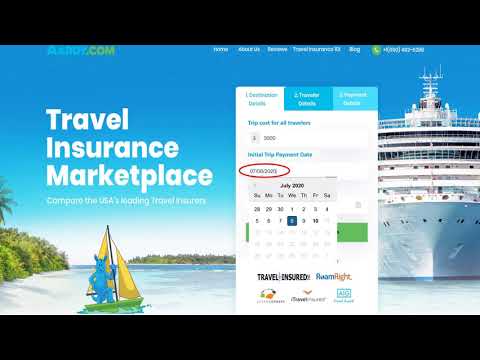

- Compare Policies from Reputable Providers: Don't settle for the first policy you see. I would like to ask what reputable companies other travelers have had good experiences with.

Look at several insurers and compare their coverage, exclusions, and prices. Consider companies specializing in international transit rules.

- Understand Coverage Details: Carefully review the policy wording to understand what is covered and what is not.

Key areas to check include medical expenses, trip cancellation or interruption, lost or stolen luggage, and emergency evacuation. They decided to discuss the importance of reading the fine print.

- Declare Pre-Existing Conditions: Failure to declare pre-existing medical conditions can invalidate the policy.

Be honest and upfront about any medical issues the traveler has. She expresses the opinion that it's always better to be safe than sorry.

- Pay Close Attention to Exclusions: Most policies have exclusions, such as adventure activities, high-risk destinations, or certain types of medical treatment.

Make sure the policy covers the traveler's planned activities. He considers it important to note that adventurous activities may require additional coverage.

- Consider Additional Coverage Options: Depending on the traveler's needs, consider adding optional coverage for specific items, such as electronics or sports equipment.

They express their readiness to begin exploring options to improve the level of cover.

- Confirm Visa Requirements: Ensure the traveler has the necessary visas for their destination(s). Some policies may cover visa application fees if the application is denied.

He would like to clarify how visa rejections are handled by different insurance providers.

- Check Passport Validity: Many countries require passports to be valid for at least six months beyond the intended stay. Verify that the traveler's passport meets this requirement.

I believe that checking passport validity is one of the most important pre-trip tasks.

- Provide a Copy of the Policy to the Traveler: Make sure the traveler has a copy of the policy, including the policy number, contact information for the insurer, and instructions on how to file a claim.

She thinks that easy access to policy documents is crucial in case of emergencies.

This matches feedback from frequent travelers on Reddit — documentation is key!

| Coverage Area | Example Coverage | Typical Exclusion |

|---|---|---|

| Medical Expenses | Covers hospital bills, doctor visits, prescription medications | Pre-existing conditions (unless declared and covered) |

| Trip Cancellation | Reimburses non-refundable expenses if the trip is canceled due to illness, injury, or other covered reasons | Cancellation due to a change of mind or fear of travel |

| Lost/Stolen Luggage | Covers the cost of replacing lost or stolen luggage and personal belongings | Unattended luggage or valuables left in public places |

| Emergency Evacuation | Covers the cost of transporting the traveler to a hospital or medical facility in case of a medical emergency | Evacuation to a higher standard facility than medically necessary |

He starts the conversation with how to compare similar policies from different vendors.

- Budget Travel Tips: Compare policies across different insurers as prices can vary substantially.

Consider a higher deductible to lower the premium. I think that finding the right balance between price and coverage is essential.

- Cost-Effective Routes: Depending on the location of the traveler, consider overland journey planning as this might impact the type of insurance that is needed.

They believe that overland travel comes with different risks and the insurance should reflect this.

- Off-Peak Train Fares: If the traveler is using rail, buying off-peak tickets can save money, leaving more available for the insurance policy.

Based on my opinion, traveling off-peak also decreases travel time with fewer passengers.

This is critical to ensure budget travel fits the right coverage.

It seems to me that buying travel insurance for someone else involves careful planning and attention to detail.

We believe that ensuring the traveler is adequately protected is well worth the effort. I would like to discuss the importance of understanding the policy's terms and conditions before making a purchase.

A small investment that protects from large potential costs.